Petty Cash Book: Types, Format, Operations, Pros, Cons

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. For this purpose, he is given a small amount and a separate book to record these small payments.

Establish petty cash policies and procedures

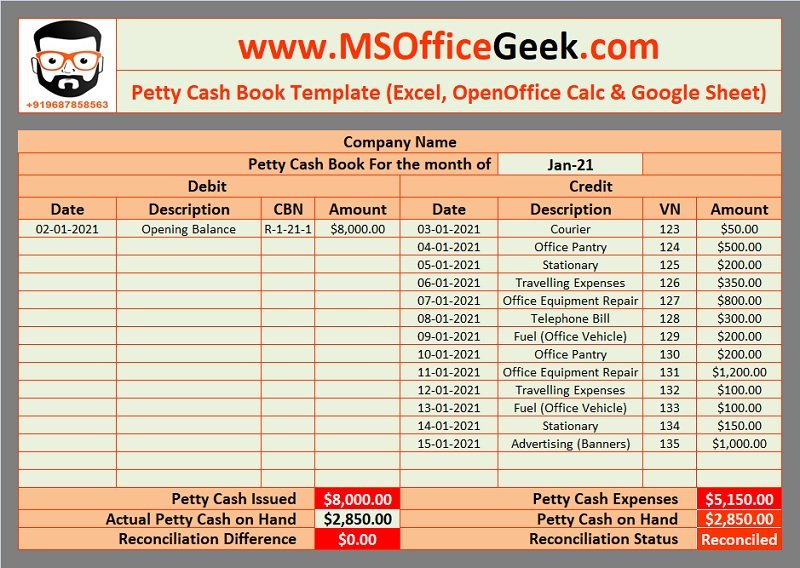

This cash book style includes various columns to monitor everyday transactions. This balance represents the amount of cash available in the petty cash fund at the beginning of the accounting period. Ensure that the opening balance of the petty cash fund is accurately recorded.

Reduced risks of fraudulent expenses

These receipts can be exchanged for a new check made to cash the total amount equal to the receipt. Once the check is cashed, this amount will be added to the petty cash fund to restore the funds to its original level. Balancing of a petty cash ninja loan financial definition of ninja loan book is done at the end of an accounting period. The columns for “payments” and “expenses” are totalled and it equals the total in the “Total Payment” column. Under the ordinary system, a lump sum amount of cash is given to the petty cashier.

Start your petty cash log

All they need to do is enter in the information, and the app will do everything else for you. Even though petty cash might seem minor, you still need a proper organizing and record-keeping system, with a clear audit trail of every expense. In the analytical type petty cash book, the closing balance (balance c/d) then becomes the opening balance (balance b/d) of the next period. In this way, the petty cashier will begin every period with an amount equal to imprest cash, and the amount held by the petty cashier will never exceed this.

How to record petty cash in accounting?

The petty cash book is a book of vouchers which are made each time an expense is made from petty cash (money). Always the voucher would show the amount, purpose, recipient, general ledger account number and date relating to the expenses. If person receiving the petty cash and the person giving out the petty cash would sign the voucher and any supporting certification (such as revenue) would be involved. A simple type of petty cash book is one that is maintained simply with the help of 2 primary columns, one for receipts (left) and one for payments (right).

- Therefore, in this method, the workload of cashiers is minimized significantly.

- Without proper and periodic reconciliation of the petty cash book, non-compliant errors may go unnoticed and hinder the authenticity of the financial statements of the company.

- All the data is accurate with the help of auto-categorization and expense mapping rules.

- There’s a potential risk of funds being used for unauthorized or personal expenses.

A digital petty cash book is an excellent start for modernizing your expense management, offering enhanced accuracy and streamlined record-keeping. While petty cash funds only take care of small expenses, these funds still need to be managed correctly. Keeping track of these petty cash expenses helps you to capture all your tax-deductible expenses. With a petty cash log sheet, you’ll have an itemized list that you can put on your tax return.

The amount spent by the petty cashier is reimbursed, thus making up the balance to the original amount. To solve these problems, the chief cashier delegates responsibilities to another senior staff member to account for day-to-day small transactions. In addition, the chief cashier in a large business is required to handle numerous large transactions on a daily basis. If you need help getting a petty cash log started, look up some free petty cash log templates to do some of the work for you.

And most of it is small-time stuff – padding expense reports, stealing inventory and office supplies, or misappropriating cash. A petty cash log book can help keep temptation away from your employees. The honor system can be great under the right circumstances, but it’s much safer if all your cash is locked away in one place and accounted for.

To combat this, make sure your employees understand upfront what petty cash can and can’t be spent on. Mobile apps can deliver real-time notifications and alerts to designated personnel. Whether it’s transaction approvals, fund replenishment needs, or discrepancies, these mobile alerts ensure immediate awareness, enabling swift and informed decision-making. These cards offer a secure and convenient alternative to handling physical cash that is more prone to loss or theft.